16 February 2022

By Justin Bgoni

The stock market has been around for many centuries, having evolved over the years in line with technological changes. A stock market also known as a stock exchange is a market where securities are bought and sold. It is also a platform where capital is raised to fund operations of a business.

Zimbabwe has one of the oldest stock exchanges in Africa dating back to the early 19th century. The Zimbabwe Stock Exchange (ZSE), formerly Rhodesia Stock Exchange, having been established around 1894 has stood the test of time over the years, and remains the backbone of the country’s capital markets.

How the Stock exchange works

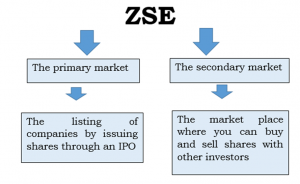

The stock market may be thought of in terms of its two separate market functions:

- Operating the primary market, where companies raise money by issuing securities which include shares to investors

- Operating the secondary market, where investors buy and sell those shares at prices determined by market forces.

A look at the Primary and Secondary Market

Knowing how the primary and secondary markets operate is key to understanding the trading activity on the stock exchange.

The primary market

The Stock Exchange provides an avenue where, for example, a company raises funds (capital) to expand its businesses by offering new shares to the public, and this process is referred to as a float or initial public offering (IPO).

The public therefore extends capital to the company in return for part ownership (shareholding) in the company. This aspect, where an institution raises money by selling securities directly to investors, constitutes the primary market.

The Secondary Market

The stock exchange provides an avenue for investors to dispose of their investments for cash or other securities. In the secondary market, buyers and sellers come together, determine a price and then exchange the shares for payment. This is what the general public observes on a day to day basis.

Shares can only be bought and sold on the ZSE through a Stockbroker. The ZSE uses an electronic platform called the Automated Trading System (ATS) for the purchase and sale of securities (shares, bonds, debentures, Exchange Traded Funds etc) listed on ZSE. The ATS has an order matching engine which electronically matches and executes “buy” and “sell” orders that stockbrokers would have put into the system on behalf of investors. The ATS is different from manual trading in that there is no human intervention in the processes of matching orders.

One of the important roles of the ZSE is to provide a regulated platform for secondary market buying and selling of securities. This allows investors to confidently trade on the ZSE. The ZSE has a supervisory role over the trading activities of the market and monitors the trading on a daily basis. Trading on the ZSE takes place during the ZSE Trading hours (0930-1300 hours) weekdays except on weekends and public holidays. Investors can consult their Stockbroker or Financial Advisor when trading on ZSE.

If you have any questions email us ([email protected]) or interact with us on our social media platforms @Zimbabwe Stock Exchange on Twitter, Facebook, Linkedin and Instagram.

Please note that it is important for all prospective investors to carefully consider their financial situation and consult a financial advisor or stockbroker in order to understand the risks involved and ensure the suitability of their situation prior to making any investment decision.

For additional information about investment options; visit

Website: www.zse.co.zw

Email: [email protected]

Tel: +263 24 2886830-5